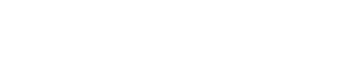

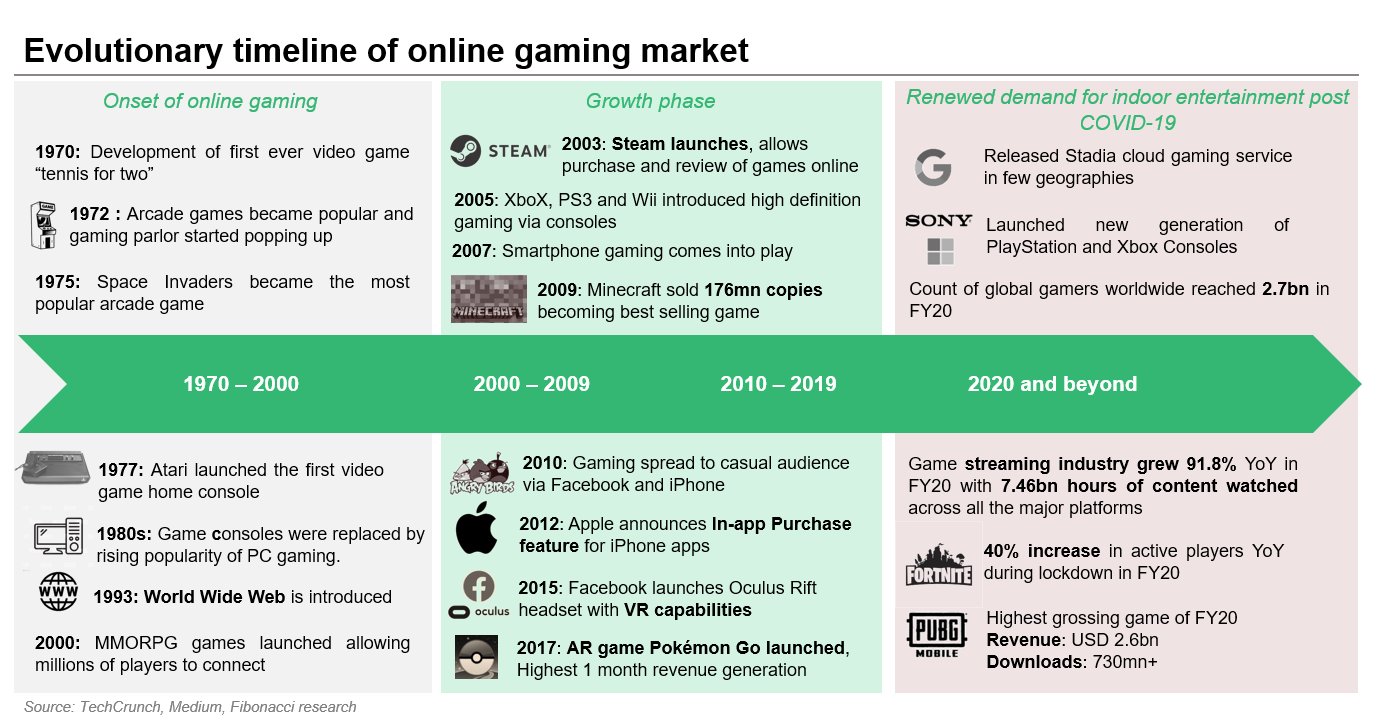

COVID – 19 lockdown protocols have accelerated digital consumption, and as an offshoot, online gaming players base has also expanded substantially in 2020. As per estimates from Verizon, overall web traffic was up nearly 20% since lockdown began but online gaming during peak hours went up 75%. Comparatively, video streaming increased by only 12% and social media usage has remained almost flat. As per estimates, there are now more than 2.6bn online gamers across the world and the market is projected to grow with 7.7% CAGR to reach USD 200bn by 2023.

APAC, with 1.4bn gamers, will account for close to 50% market worldwide in 2023. The growth is expected to be buoyed by long – term growth trend in China and explosion in mobile device usage in South East Asia (SEA). North America, the 2nd largest region by revenue accounted for a quarter of the 2020 global gaming market and Europe represented just under a fifth of the global gaming market.

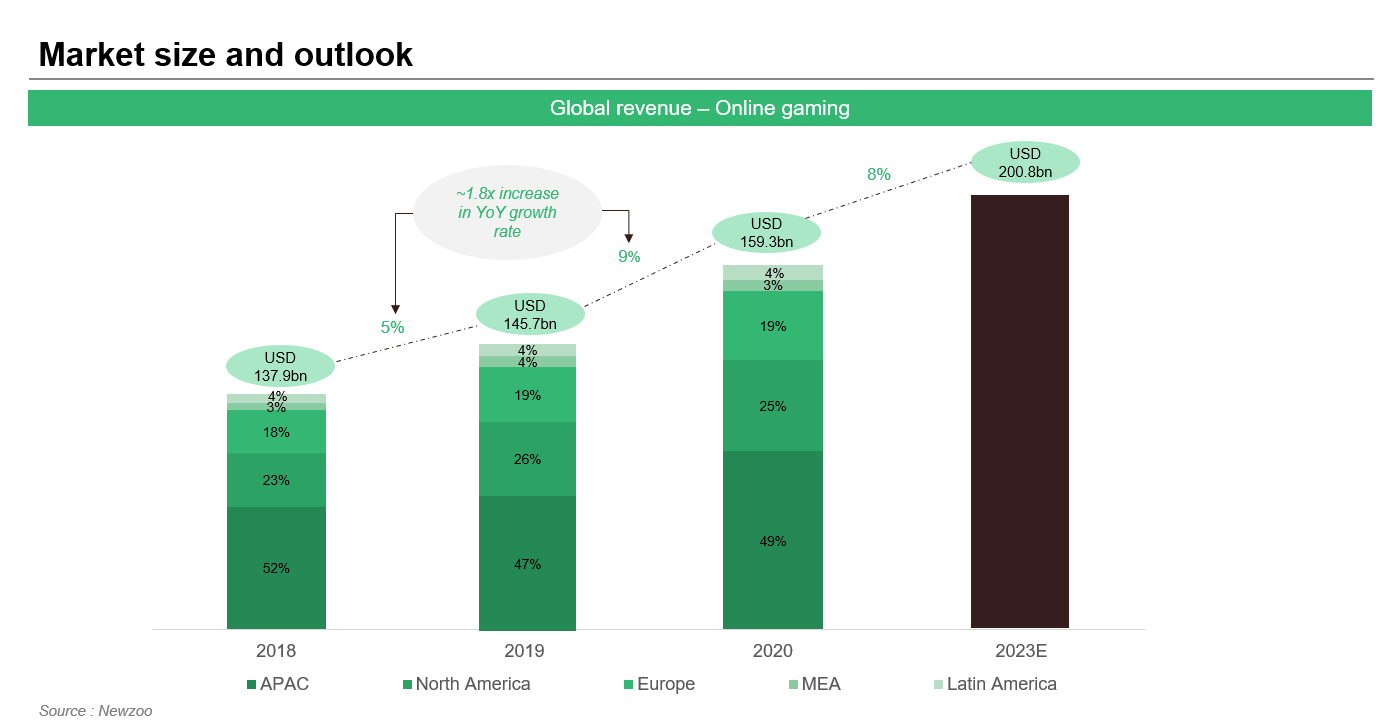

The ecosystem is fragmented with variety of players across the value chain. The underpinnings of the industry have shifted from offline to online as major activities like distribution and after sales activities have been completely digitized. Game developers rely on expertise of publishers and retailers to reach out to the audience. Hardware developers are constantly innovating to bring newer to life experiences like VR and AR tech into the pipeline. We expect the future of gaming to be focused around community building and streaming services, and Esports facilitate just that by attracting fans from all over the globe eager to spectate, participate, and otherwise engage with the broader gaming community.

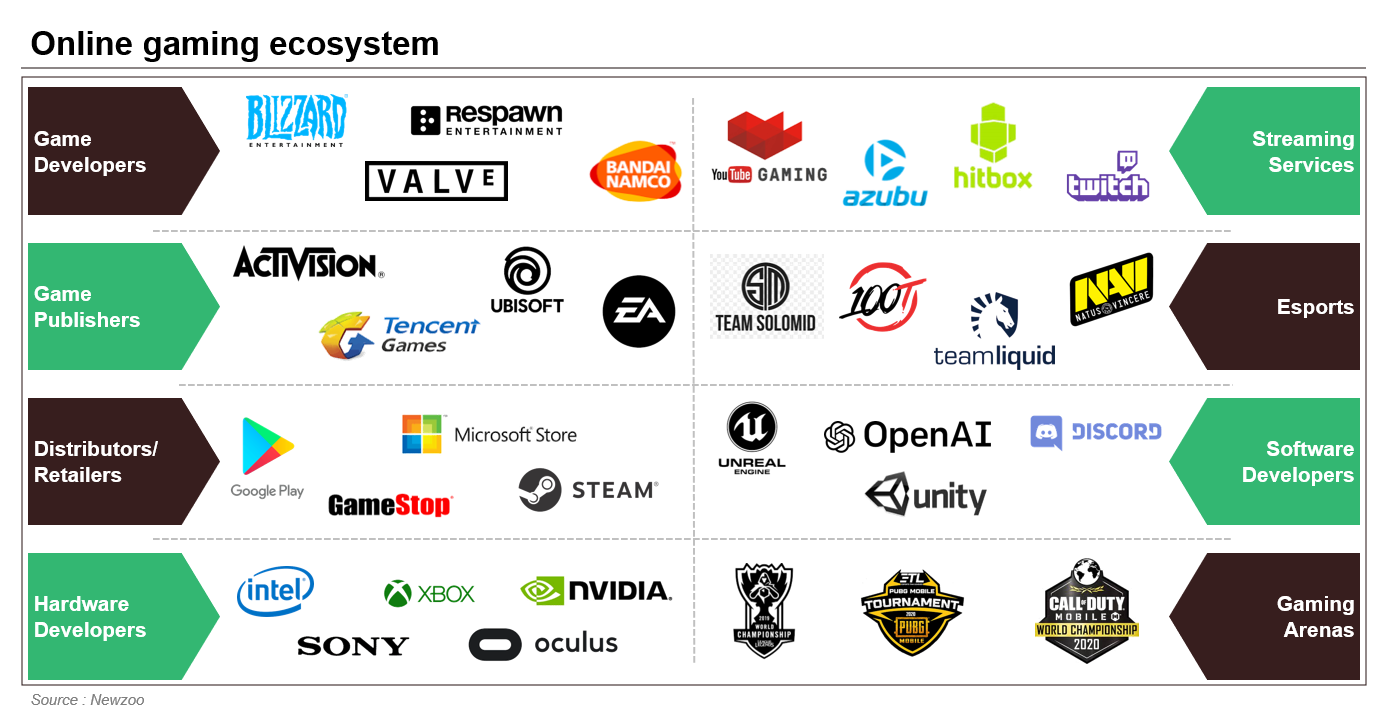

On expected lines, smartphones constitute the largest gaming platform, contributing USD 63.6bn in revenue in FY20 (40% of the global gaming market). The user base for smartphone gaming segment has grown at CAGR 9.4% (FY18-20); ~2x the CAGR of global gaming users at 5.4% (FY18-20). According to AppAnnie, Impressions per Daily Active User were up 51% YoY for smartphone games due to strategic ad placement. Also, consumer spend on smartphones hit new heights of USD 143bn up 20% YoY of which 70% went in games. This steep growth can be attributed to innovative and seamless UI relying on engaging features like in-app purchases and loyalty rewards.

Consumers today are buying fewer games but their average playtime is going up, shifting the business model from single-unit sales to recurring revenue generation from a dedicated active user base. Particularly for GenZ and millennials, games are replacing social networks as the go-to digital destinations to meet and socialize. As per estimates from Limelight Networks Inc, global weekly average playtime increased significantly by 14% YoY to reach 8.5 hours per week during the pandemic in FY20. This cultural shift is driving tech giants offer a loop design / non-linear model for online games.

User-generated content (UGC) gaming, dubbed as “YouTube of Gaming”, potentially holds a revenue-generating, scalable alternative to traditional games by offering monetizing opportunities from user-created open-ended experiences. Games such as “Fortnite” and “Call of Duty” are increasingly adding UGC features and integrating tools to create and share content. Also, creators and influencers are targeted by developers and exclusivity rights are reduced to increase visibility and engagement with the audience. For example, “PUBG Mobile” and “Fortnite” hosted virtual live concert collaborations with strategic celebrities increasing game downloads by 2.7x.

With more than 2.7bn gamers worldwide, cloud-based gaming holds the key to the future of online gaming. It eliminates a need for specialized hardware and gives the game developers a chance to create an enriching experience without worrying about available computing power. Telecom companies and Internet Service Providers (ISPs) are upgrading existing infrastructure to support higher bandwidth and the 5G push globally will be the key factor that could topple the software developers in exchange for cloud gaming providers as leaders of the market.

Esports have almost become mainstream during the pandemic as various sports leagues turned to online gaming to engage with fans and broadcasters were eager to fill hours of scheduled sports content that were cancelled in the wake of the pandemic. “Esports” is competitive, organized gaming where competitors from different leagues or teams face off in the popular games and are attended live by millions of fans live or streamed online. In simple terms, it is a premier league of video games. The global Esports market size was valued at USD 1.48bn in 2020 and is expected to expand at a CAGR of 24.4% (FY20 – 27). Investments to improve infrastructure in league tournaments are positively correlated with an increase in user engagement and the growing popularity of live stream gaming is instrumental in driving the market growth. Esports companies are estimated to generate collective revenue of USD 973.9mn in FY20 with a Y-o-Y growth of 1.7% as opposed to expectations of just USD 897mn in FY20 revenues.

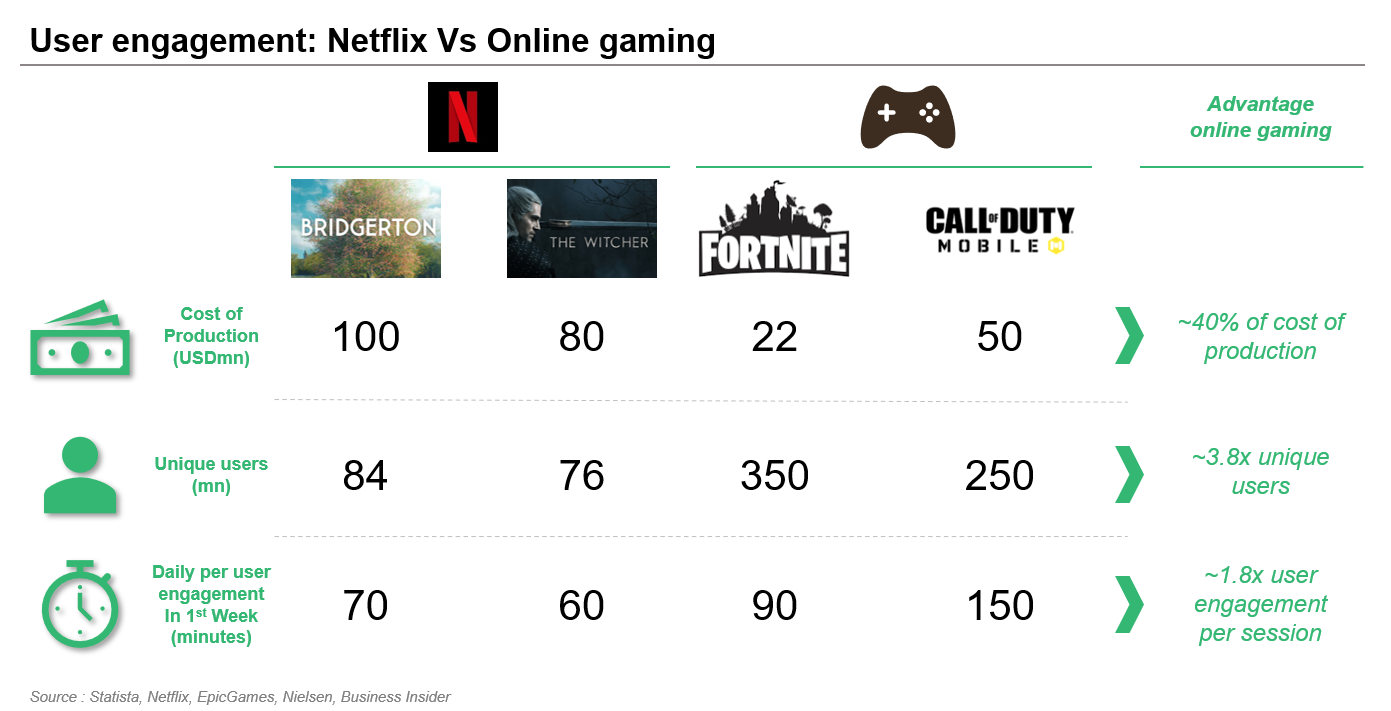

According to AppAnnie, 99 of the top 100–grossing mobile games in the United States are free. The premium games market is worth ~USD 18.5bn globally and the top 10 franchises control 50% of the market share. If we compare this with movies business, top 10 blockbuster Hollywood movies accounted for ~33% of the US box office. Game publishers are increasingly leaning towards “Netflix based Model” and looking for innovative revenue models which can ensure predictable recurring cash flow. In FY20, 25% more publishers earned >USD 2mn per annum on either Google Play store or Apple App Store benefitting from increased user engagement and higher downloads.

Gaming has emerged as one of the fastest-growing segments for the TMT industry and is expected to benefit in the long run from the growing user base. UGC gaming appeal to mass-market allows low budget base level game designers an entry door to the top players club. Monetisation is likely to follow the increase in consumption as cloud connectivity grows while keeping fundamentals remain strong. The driver for entertainment industry is online gaming and the driver for online gaming is the desire to feel connected.

References

Featured image credit: https://unsplash.com/photos/hIXmJH9xhoo

Anderton, Kevin. “The Business Of Video Games: Market Share For Gaming Platforms in 2019 [Infographic].” Forbes, Forbes Magazine, 26 June 2019, www.forbes.com/sites/kevinanderton/2019/06/26/the-business-of-video-games-market-share-for-gaming-platforms-in-2019-infographic/?sh=6dea9f037b25.

Jones, Katie. “Online Gaming: The Rise of a Multi-Billion Dollar Industry.” Visual Capitalist, 15 July 2020, www.visualcapitalist.com/online-gaming-the-rise-of-a-multi-billion-dollar-industry/.

Wijman, Tom. “The World’s 2.7 Billion Gamers Will Spend $159.3 Billion on Games in 2020; The Market Will Surpass $200 Billion by 2023.” Newzoo, 1 Oct. 2020, newzoo.com/insights/articles/newzoo-games-market-numbers-revenues-and-audience-2020-2023/

Shanley, Patrick. “Gaming Usage Up 75 Percent Amid Coronavirus Outbreak, Verizon Reports.” The Hollywood Reporter, 18 Mar. 2020, www.hollywoodreporter.com/news/gaming-usage-up-75-percent-coronavirus-outbreak-verizon-reports-1285140.

“The State of Mobile 2021.” App Annie, App Annie, www.appannie.com/en/go/state-of-mobile-2021.