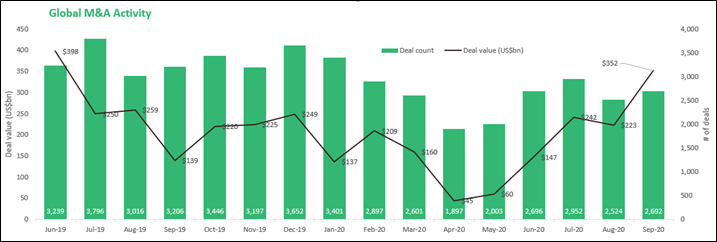

Global M&A activity has witnessed strong activity in Q3 2020 despite a slowdown in the initial months of 2020 due to COVID – 19 pandemic and the great lockdown. Total global M&A deal value was 2.5x in September 2020 when compared to global M&A deal value in September 2019. This can be largely attributed to execution backlog from Q2 2020 and limited financial activity due to lockdowns across countries. Overall, 2020 has witnessed stronger M&A activity than expected in the initial months of the year as financial activity has adjusted to the new normal.

Source: Flashwire Advisor Quarterly, FactSet

COVID – 19 has presented an unprecedented challenge to the CXOs and Corporate Development managers. Some companies are better placed than others to undertake M&A activity, obvious factors including balance sheet health and sector dynamics will play a crucial role. It is logical to insinuate that sectors including aviation, hospitality, and leisure are not witnessing a lot of M&A activity at the moment. Although, these sectors may see M&A activity soon where cash rich strategic and financial players may acquire stressed companies. On the other hand, consumer retail, technology, and healthcare are witnessing strong demand and witnessing relatively stronger M&A activity. In both cases, companies are likely to explore growth routes in addition to M&A, including partnerships, JVs, and other emerging adjacent opportunities.

Series of mega deals have pushed the total deal value in second half of 2020. Older deals on hold coming back to life, liquidity push from central banks, and cash hoarding by large companies has made it possible for mega deals to get through in H2 2020. As per industry estimates, S&P 1200 companies have stashed a record USD 3.8tn in cash reserves. As reported by MarketWatch, nine deals worth USD 5bn or more were announced in August alone — the biggest count for that month since 1999. As expected, these deals were dominated by the technology and health-care sectors.

This resurgence in mega deals comes after large global companies had aggressively tapped into available lines of credit in H1 2020, planning to boost their cash reserves since their top line collapsed, as the strictest of the lockdowns were imposed across countries.

Mega deals: Technology and healthcare sectors will continue to see large deals in the coming quarters with focus on technology services, EdTech, AI, data analytics, technology infrastructure, and pharma. Examples, Salesforce.com agreed to pay USD 27.7bn to buy Slack; Johnson & Johnson agreed to buy biotech company Momenta Pharmaceuticals USD 6.5bn.

Distressed deals: We expect play through PE route in mature companies which are indebted and were hit hard by the pandemic. Although central banks and governments globally have pumped credit into the market but access is limited for companies with weak credit ratings. This will nudge these companies towards PE and other institutional players. Example, Apollo has invested USD 1.2bn alongside Silver Lake Partners in Expedia Group Inc, whose online booking business was hit hard by the coronavirus-induced stay-at-home orders and travel bans.

Minority deals: Companies will look to de-risk M&A and look for alternative ways to enhance capabilities and new market access through minority deals and partnerships. Example, Facebook and Google investing total ~USD 10bn in Reliance Jio Platforms.

PE deals: PE players are focusing on pharma, technology, telecom, energy and real estate sectors. There were several mega deals through the years including USD 19.7bn purchase of Germany-based Thyssenkrupp AG’s elevator unit by an Advent International and Cinven-led consortium. We expect more such deals as PE funds have piled up dry powder estimated to be ~USD 1.7tn as on July 2020 as per PE hub.

VC deals: Late-stage funding outpaced early-stage funding and we expect this trend to continue. Funding rounds above USD 500mn were closed by Airbnb, Zuoyebang, Sana Biotechnology, Stripe, Palantir Technologies and Tokopedia. As we move forward into economic uncertain waters, we expect a further squeeze on early stage and growth stage companies and more and more focus on too big to fail investments.

PE / VC exits: Private equity firms have marked down portfolio valuations (not all to the same extent) and are more likely to hold onto assets for longer. For venture-backed IPOs, ZoomInfo raised the largest amount at USD 935mn, and Vaxcyte, developer of a vaccine for COVID – 19 raised close to USD 250mn.

We expect companies to deploy both defensive and offensive M&A strategies in the next few quarters as managers learn to navigate the new normal. Defensive strategies will be deployed by firms who have struggled to adapt their business model with changing nature of demand in the midst of COVID – 19, Alternatively, offensive M&A strategy will be employed by companies which have been able to ride the demand curve through digital transformation and now these players will be looking to establish themselves as market leaders.

If you are an industry leader inclined towards potential M&A, or if you are looking to attract potential buyers please feel free to get in touch at solutions@fibonacci.global

References

Featured image credit: Cytonn Photography https://unsplash.com/photos/GJao3ZTX9gU?utm_source=unsplash&utm_medium=referral&utm_content=creditShareLink

Deloitteeditor. “In a Post-COVID Economy, M&A Emerging as a Big Deal.” The Wall Street Journal, Dow Jones & Company, 14 Aug. 2020, deloitte.wsj.com/cfo/2020/08/11/in-a-post-covid-economy-ma-emerging-as-a-big-deal/.

Flashwire Advisor Quarterly, FactSet, www.factset.com/hubfs/mergerstat_em/quarterly/AdvisorQuarterly.pdf.

Saigol, Lina. “Surge in Megadeals Points to M&A Recovery as Tech Sector Dominates.” MarketWatch, MarketWatch, 2 Sept. 2020,

“Opinion: PE Investments Expected to Bounce Back from Covid-19 Shock: Bain & Co.” Mint, 11 July 2020, www.livemint.com/opinion/online-views/opinion-pe-investments-expected-to-bounce-back-from-covid-19-shock-bain-co-11594463891834.html.

Robertson, Benjamin. “Private Equity Titans Turn to Europe for Mega-Deals.” BloombergQuint, Bloomberg Quint, 16 July 2020, www.bloombergquint.com/business/private-equity-titans-turn-to-europe-for-mega-deals.

Teare, Gené “Q2 2020 Global Venture Report: Funding Through The Pandemic.” Crunchbase News, Crunchbase News, 6 July 2020, news.crunchbase.com/news/q2-2020-global-venture-report-funding-through-the-pandemic/.

Ketabchi, Natasha. “The State of Private Equity in 2020.” Toptal Finance Blog, Toptal, 29 Oct. 2020, www.toptal.com/finance/private-equity-consultants/state-of-private-equity.