The world as we know it is changing very rapidly because of ongoing COVID-19 pandemic crisis. Some people believe that we are possibly going to be dividing time between pre COVID-19 and post COVID-19 eras, replacing the two thousand years old idea of BC and AD.

This might or might not turn out to be true, but surely these are times of extreme uncertainty and we are closely monitoring the trends to try and get a grip on the post COVID-19 world. The purpose of this article is to share some of the trends that we foresee, however it goes without saying that a lot is unknown at this stage and we might get a clear assessment of the impact on society, politics, economies, and businesses only by mid-2021.

These are of course broad global strokes, and the exact trends might vary by country.

Society and Culture

Over the past decade or so we have seen a rising trends towards vegetarianism, and we believe that this trend towards vegetarianism will not only continue but even accelerate a little bit. This is not just because of the roots of the SARS-COV2 virus, but also because of a growing awareness and concern regarding climate change. Particularly in China, we have seen a drop in the consumption of meat from exotic animals even as local wet markets have opened for business.

The trend towards vegetarianism is giving birth to a new industry, Plant based Meat and Lab grown Meat. In Dec’2020, Lab-grown meat got regulatory approval to operate commercially in Singapore, whereas plant based meat companies such as Beyond Meat have been operational globally since over a decade. Apart from Asia, similar trends have been noticed in the US, UK and EU as well. Brands such as Pizza hut, Domino’s and Taco Bell have already jumped at the opportunity and have started plant based meat offerings across different locations. Various industry reports peg the industry to reach a size of USD 25 to 35 Bn in the coming 5-7 years.

Throughout the period of this pandemic, we have been getting more and more dependent on technology for fulfilling our basic needs, including ordering food, buying daily groceries, transport, seeking entertainment or shopping. This will get further accelerated in the near future. Popular belief is that it takes ~21 days to form a new habit while recent scientific studies say it takes ~66 days. So, regardless of whether we go by popular belief or science, our technology dependencies have been firmly cemented during this lockdown.

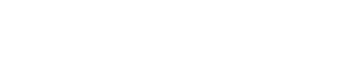

If we look at our use of technology through the lens of Maslow’s hierarchy of needs, we notice that we started with basic needs fulfillment using technology, but now we are slowly moving upwards and soon all our needs will either be technology enabled or completely technology dependent. Broad patterns have emerged across the hierarchy levels as we learn to coexist with COVID-19.

Physiological: During the beginning of the pandemic, we observed “pantry panic” as governments enforced complete lockdown. We saw surge in online demand for canned food. Also, the value and volume of online food orders has been going up as people are still skeptical of going out to eat. According to a US nationwide survey conducted by grocer Good Eggs in August 2020, two-thirds of people have bought groceries online compared to only 13% one year ago (August 2019, by Brick Meets Click). The most important finding from this survey is that 81% of people say that they will continue online grocery shopping post COVID-19. Similar trends have been noticed for food delivery across the globe as well.

Safety: Besides the obvious rise in demand for disinfectant wipes and sanitizers, demand for vitamins and health supplements as additional preventive measure has gone up steeply. This has buoyed the revenues for FMCG multinationals such as Nestlé, Procter & Gamble and Reckitt Benckiser, that have been aggressively building their position in the sector over the last few years. According to Nielsen, US dietary supplement sales were 16.7% higher than a year in the four weeks to July 11 and a 51.2% jump in demand since the COVID-19 pandemic started.

Extended lockdowns and social distancing have further accelerated the use of digital financial services channels. As per a report from SimilarWeb on US banking, consumer interest in safe, low-yield accounts is also on the rise. Searches for CD accounts were up 25% in March for the top 10 players. Also, Chase, Bank of America and Wells Fargo all encouraged customers to download their app to receive help, resulting in a 28% increase in weekly iOS downloads. As a proactive measure, most big banks have created COVID-19 help content that is shown on their homepage. Going forward, consumers will expect a seamless banking experience, and Direct Banks / Neo Banks will have an opportunity to steal market share from established players. Digital laggards in the retail banking industry will have to adapt swiftly to the changing customer demand or will have to partner with one the Neo Banks to stay competitive. Digital payments have seen an obvious boom. India saw UPI (United Payments Interface) based transactions rise by over 100% in 2020, in both value and volume. It is also a prime global case study of successful government initiatives to enable digital payments with healthy participation of private players such as PhonePe, Google Pay and PayTM. Eventually at some stage we will also see adoption of digital currencies in the mainstream, as Governments and Financial Institutions increase their interest in them.

Education is another great example of an entire sector moving online almost overnight. Since schools have been shut in most countries, most of the teaching and learning is happening now through digital channels. Even after all lockdowns are over, we expect a healthy mix of online and offline learning to be prevalent in society.

Love and belonging: People have been getting together with families and friends through online platforms. Once the “cabin fever” set in, there was a surge in demand for board games, virtual tabletop role-playing games, beer, wine, and even items to update indoor and outdoor spaces. People have also turned to platforms like Zoom and Google Hangouts for happy hours and have also planned virtual dinner parties with friends and extended families. There is also a new trend of virtual concerts and comedy shows on Zoom along with influencers building their communities on discord.

The culture of going out for the movies, eating and drinking out is likely going to see a permanent change. We were anyway moving towards indoor entertainment and this lockdown has likely cemented this habit as well. Many restaurants will either have to pivot to become a cloud kitchen and many might have to shut down permanently. Entertainment has been moving towards OTT platforms with famous directors, actors and celebrities endorsing it and taking part in the digital ecosystem. Since most movie halls are shut, OTT players such as Amazon Prime and Netflix have been able to facilitate release of movies on their platforms and have seen huge viewership and subscription gains in this time period. In fact, a lot of the cinemas might never open again, as people get more and more used to consuming content from the comforts of their homes.

Novelty businesses might still have a conducive offering such as IMAX, fine dining, Sushi and Craft beer. But the outdoor culture as we know it is going to change forever and we will see a spurt in the urban indoor culture.

Basic norm of social distancing and lockdowns have reduced consumer and business activity to the bare minimum, and online gaming has offered an engaging activity for people confined to their home looking for social connection. It is the fastest growing segment in the global technology industry today. As per World Economic Forum (WEF) report, data shows huge growth in playing time and sales since the lockdowns began. As per WEF estimates, the global video game market is forecast to be worth USD 159bn in 2020, around four times box office revenues (USD 43bn in 2019) and almost three times music industry revenues (USD 57bn in 2019). The biggest market by revenue is Asia-Pacific with almost 50% of the games market by value. Industry experts expect to see the gaming industry increase its partnerships with other entertainment sectors. Overtime, we expect some video games to become so popular that they will eventually spill over into cultural discourse.

Esteem: As lockdowns continue around the world with some relaxations, most people seem to want to make the most out of this crisis. As people spend more time indoors, they naturally have the urge to make the home environment more conducive to both physical and mental well-being. There is emergence of trends such as power nesting through updating the living spaces and “insourcing of materials” for updating home office and using expensive home furnishings. According to industry estimates, Global Online Home Decor market size is estimated to grow at CAGR of almost 13% with Revenue USD 83bn during the forecast period 2020-2024.

There has also been a strong surge in demand for fashion and clothing items through online channels. As per a report from Reuters, Zara’s holding company Inditex, the world’s biggest fashion retailer, expects their online sales to make up a quarter of its sales by 2022, compared to 14% now, after a 95% surge during lockdown conditions in April. Also, H&M reported that its group sales halved in March-May and were down 30% in the first 13 days of June even as stores started to reopen. Online sales jumped 36% in March-May. According to an analyst at Bernstein, online share of overall fashion sales could hit 37% in Europe by 2030.

Self-actualization: Focus on physical and mental fitness as preventive tool for protection against COVID-19 has led to people purchasing fitness equipment, signing up for online workout, yoga and meditation sessions. There are about 400,000 apps on Google Play Store and Apple App Store which work on mental health and / or meditation in some form or fashion. As per a Forbes report, Mindbody, a global technology platform that connects the consumers to wellness providers, has witnessed a huge jump in consumers accessing virtual content since March of 2020. 73% of consumers are using pre-recorded video versus 17% in 2019; 85% are using livestream classes weekly versus 7% in 2019. Yoga has been the most popular virtual class booked on Mindbody, making up 32% of virtual bookings with an average of nearly 22,000 yoga bookings per day. Following yoga, the most popular virtual bookings are High Intensity Interval Training (15.6% of virtual bookings), Pilates (8.3%) and Barre (7.9%).

Geopolitics

It goes without saying that this crisis will change the geopolitical landscape completely, and the post COVID-19 politics will be very different across the globe.

We are already seeing a surge in protectionism and this will reach new heights in post COVID-19 world. We expect globalization agenda to definitely see a huge setback in the short term. As per the Global Trade Alert team at Switzerland’s University of St Gallen, as of 21 March 2020, a total of 54 governments have implemented some type of export curb on medical supplies and medicines associated with the COVID-19. Several countries including France, India, and UK have implemented multiple export curbs, further hardening the provisions of export limits.

We will most likely also witness a shift in manufacturing and investments from China to other low-cost countries (LCCs). For example, German footwear manufacturer, Casa Everz Gmbh, has decided to shift its entire production from China to India. Also, Japan has earmarked USD 2.2bn of its economic stimulus package to help its manufacturers shift production out of China as the coronavirus disrupts supply chains between the two countries. We expect this trend to continue as countries look to cover the downside by limiting overreliance on a manufacturing hub.

Nationalist parties and nationalist agenda will continue to do well across the globe. We should not be surprised if citizens start getting their options between “Right” and “Far Right” ideologies, the way it is in Israel.

We also expect to witness a surge in Socialism and Keynesian economics. It is inevitable given the way the economic fall out of this crisis will hit the poor and the bottom of the socio-economic pyramid, increasing the wealth gap between the Haves and Have-Nots. Governments will have to take leadership in terms of spending to support the marginalized sections of the society. We possibly might see few Universal Basic Income (UBI) experiments in the post COVID-19 world.

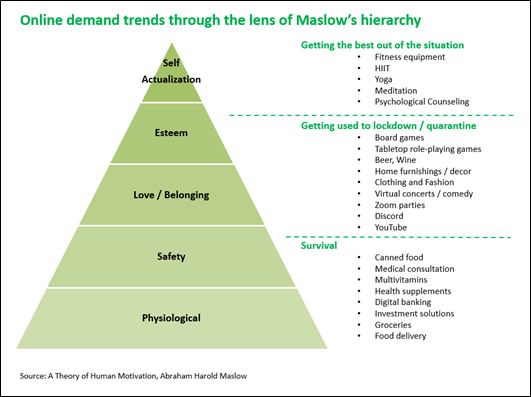

China will rise as the second pole of power in the world if it had not already risen, and similar to the cold war days we will live in a Bipolar world for a few years or decades. At the time of writing this article, China had not only re-opened their entire economy but also started shipping their goods to the world while rest of the world is still reeling with lockdowns. As expected, the recent spike in exports can be attributed to global demand for medical supplies and work from home equipment.

Source: CNBC, China customs, Refinitiv

There is a lot of negative sentiment developed against China from the western world and all sorts of political and economic considerations are under discussion. There is a confidential white house report on the role of China and there is also a bill in US senate which calls for sanctions on China.

Soon enough many countries will be forced to take sides, however we are hopeful that a group of countries might continue to be non-aligned. Indian Prime Minister, Narendra Modi recently attended his first NAM summit and he highlighted the fact that the current crisis has exposed the limitations of the current global order and we need to explore the alternatives.

Economics

Because of the rise in nationalism and protectionism we foresee a significant decline in the global trade. As per the estimates from WTO, global trade would fall this year by between 13% and 32%. At the height of 2008 GFC, global trade dropped by 12.5%. There will be a rise in local trade and an emphasis on strengthening local supply chains. In the initial phase of the economic crisis we will also see a lot of focus on moving manufacturing out of China based on sentiment. This can present a good opportunity for SE Asian countries and India.

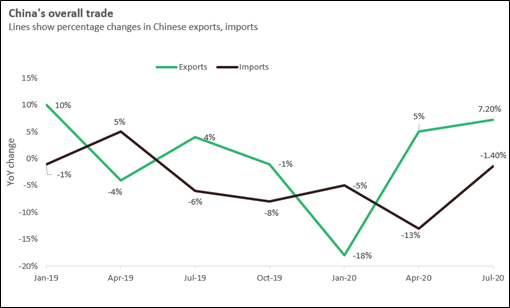

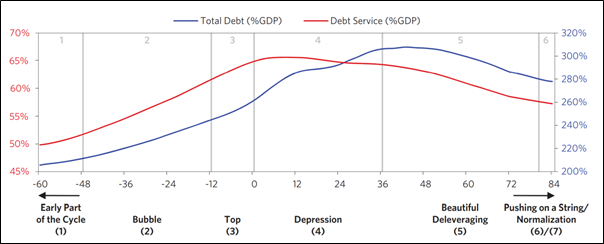

Ray Dalio, Founder, Bridgewater Associates, and one of most successful hedge fund managers of our times, has been talking about short term and long term debt cycles at various forums. He has laid out all the details in his book “Principles For Navigating Big Debt Crises”. According to Dalio, we are witnessing the end of a long term debt cycle and significant deleveraging is on the cards for 10-15 years.

Source: Principles For Navigating Big Debt Crises, Ray Dalio

He speaks about a looming economic depression, and there are a number of reasons behind his assertion, major one being that the only time in history the current economic situation can be compared with, is the time before the great depression of the 1930s. Common patterns being, years of close to zero interest rates, overpriced assets, printing of money, quantitative easing to a point where monetary policy cannot do much to stimulate the economy any further. At this point wealth gap has typically reached an unsustainable tipping point which eventually triggers a rise in populism.

The timing of this pandemic and its impact on the economies is the perfect trigger for the depression to start unfolding. Now what do we mean by a depression and how is it different from a recession? A recession is when there is decline in economic activity and production which affects employment, income and spending. Whereas a depression entails a sustained and significant decline in economic activity and production, the effects of which lead to major structural long-term changes in the underpinnings of economy and society at large. Loss of employment can get very severe in a depression. There is significant drop in global trade, capital movement and there can be sustained periods of economic inactivity. Needless to say, an economic depression takes a huge toll on human life. We hope that we all make better decisions and do not create the situations which the world saw in the 1930s.

Both these economic phenomena of correction start with asset prices crashing, defaults, collapse of businesses and financial institutions and eventually lead to government taking drastic measure to stabilize the whole system.

The last time around it took a world war to increase spending to a level which got the world economy out of the doldrums. It is not necessary at all for things to playout in a similar way. We are much smarter as a species and way more creative today than we were in the 1930s and hopefully we will find smarter and humane solutions.

Source: Principles For Navigating Big Debt Crises, Ray Dalio

Dalio articulates his proposed solution in very simple terms in his book and articles, which basically says that we need a careful balance between inflationary and deflationary forces to execute a “beautiful deleveraging”:

- Deflationary: Cut spending, Reduce debt, Redistribute wealth

- Inflationary: Print money

In spite of all the similarities between today’s economic situation and the one before the great depression, one difference is that this time the supply has been independently impacted because of the great lockdown. Typically, even in a recession demand impacts supply which in turn impacts demand and we see a downward spiral. However, it has never been the case that both have been independently impacted. As everyone has been saying, these are unprecedented times and nothing can be said with certainty, particularly regarding economics – the vaguest among the sciences.

Business

We already have mentioned above that the world economy is going to go through some structural changes, so it is very hard to predict what the business world would look like once those changes are made, however based on the sociocultural, geopolitical and known economic changes some trends can still be foreseen.

Work from anywhere, is the most significant change which has come upon the business world and it is most likely to stay. Earlier this trend was limited to select countries and select businesses, however this crisis has forced all of us to be prepared to work from anywhere.

As we have discussed earlier, there will be an attempt by global companies to move their supply chains out of China. We should note that the attempt to move manufacturing out of China is not a new trend. This is something which China and Chinese companies have themselves been trying to attempt for the last few years. As per the Brookings Institution, we are witnessing shift of final assembly out of China and to LCCs (Low cost countries), mostly in Southeast Asia. If we look at the effect of the trade war, there has been this shift of a certain amount of final assembly to Indonesia, Vietnam, et cetera. China is still providing a lot of the components from terms of machinery and more sophisticated components. And actually, a lot of those producers in these LCCs are Chinese firms. Because of China’s one child policy which lasted for three and a half decades, there has been a sharp decline in the labor force which is actually one of the key reasons why the policy was relaxed in 2013. So we don’t foresee any transition of supply chain happen in any sort of antagonism with China. In the medium term, this will be done in full cooperation with China and their willing participation in the process.

Generally speaking, organizations will go through a Darwinian “survival of the fittest” test. Needless to say the companies with most amount of debt will be the most at risk. The only exception to a natural Darwinian selection process would be the too big to fail organizations. Whether we as free marketeers like it or not, the government will come to the rescue of these big behemoths to avoid systemic risk. This would likely happen in the early part of the economic crisis as in the latter part governments would find the bailout process futile.

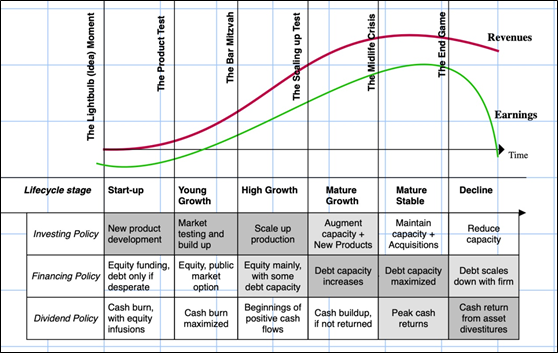

When the debt bubbles deflate, cash is going to evaporate from the startup-VC ecosystem leaving many startups which are in their early stages of growth, stranded and cash deprived. The ones which would cut costs, increase efficiency and pivot where required would survive, the others would die. The general mantra for them would be to focus on unit economics and profitability rather than growth. Survival rather than expansion. Cockroaches rather than leeches. As of writing this article the most impacted sectors were financials, energy, utilities, materials, airlines, travel and tourism, hospitality, cinemas and some of these will be permanently impacted.

The airline industry might eventually reach close to their previous peaks someday however in the short to medium term, the prices for an end consumer would be high and recovery of the sector slow. Business travel might never be the same again due to newly ingrained habit of work from home and zoom meetings during this lockdown. Travel and tourism would eventually recover but it might take years. This would also have a huge short to medium term impact on the cities and countries who are largely dependent on travel for their revenues.

Also as touched upon earlier, the hospitality and cinemas business will never be the same again because of the cultural changes that have taken place. Entertainment and social interactions will largely move indoors. Many restaurants and bars will never reopen. Most cinemas will never reopen.

Many industries which were already in maturity stage will take this opportunity to consolidate, some industries might not have an option and consolidation might be a compulsion for survival.

Source: Musings on Markets, Aswath Damodaran

Many industries which were earlier more open and competitive, would convert into monopolies or duopolies. this will also be a great time for cash rich giants to gobble up the innovative smaller players. We definitely see this happening in the tech space as we see an immense consolidation of power and capabilities with Amazon, Google and Facebook.

From an entrepreneurial perspective this would be an ideal time for new entrepreneurs to rise and disrupt the status quo in several sectors such as education, entertainment, logistics amongst others, and a digital first approach would be a winning strategy.

References

Featured image credit: Adam Chang https://unsplash.com/photos/ntBPyGZCMWg

Barnes, Matthew. Classics in the History of Psychology — A. H. Maslow (1943) A Theory of Human Motivation, psychclassics.yorku.ca/Maslow/motivation.htm.

“Mapping Lockdown Shopping against Maslow’s ‘Hierarchy of Needs’.” WARC, www.warc.com/newsandopinion/news/mapping-lockdown-shopping-against-maslows-hierarchy-of-needs/43628.

Stuckey, Barb. “Online Grocery Shopping Will Continue Post-COVID Says Data From Online Grocer Good Eggs.” Forbes, Forbes Magazine, 2 Oct. 2020, www.forbes.com/sites/barbstuckey/2020/10/02/online-grocery-shopping-will-continue-post-covid-says-data-from-online-grocer-good-eggs/.

Evans, Judith. “Rise in Vitamin Sales during Pandemic a Tonic for Consumer Goods Groups.” Subscribe to Read | Financial Times, Financial Times, 17 Aug. 2020, www.ft.com/content/fbcfe8df-4ab9-47c3-974e-320e0d320d19.

https://www.greenqueen.com.hk/plant-based-meat-demand-in-key-asian-markets-to-grow-200-percent-within-five-years-report-says/

https://www.dnaindia.com/personal-finance/report-upi-transactions-in-2020-break-record-grow-by-more-than-100-per-cent-2865981

“Online Home Decor Market Size, Share 2020 – Global Demand Status by Growth Analysis, COVID-19 Impact Analysis on Industry, Business Revenue, and Trends Forecast to 2024.” MarketWatch, MarketWatch, 27 Sept. 2020, www.marketwatch.com/press-release/online-home-decor-market-size-share-2020—global-demand-status-by-growth-analysis-covid-19-impact-analysis-on-industry-business-revenue-and-trends-forecast-to-2024-2020-09-27.

Thomasson, Emma. “Online Fashion Stocks in Vogue as Coronavirus Speeds Ecommerce.” Reuters, Thomson Reuters, 18 June 2020, in.reuters.com/article/us-fashion-europe/online-fashion-stocks-in-vogue-as-coronavirus-speeds-ecommerce-idINKBN23P1RP.

Heil, Emily. “Eating Alone, Together: Virtual Dinner Parties Are Helping People Fight Isolation.” The Washington Post, WP Company, 21 Mar. 2020, www.washingtonpost.com/news/voraciously/wp/2020/03/21/eating-alone-together-virtual-dinner-parties-are-helping-people-fight-isolation/.

Cording, Jess. “How COVID-19 Is Transforming The Fitness Industry.” Forbes, Forbes Magazine, 13 July 2020, www.forbes.com/sites/jesscording/2020/07/13/covid-19-transforming-fitness-industry/.

Gardner, Benjamin, et al. “Making Health Habitual: the Psychology of ‘Habit-Formation’ and General Practice.” The British Journal of General Practice : the Journal of the Royal College of General Practitioners, Royal College of General Practitioners, Dec. 2012, www.ncbi.nlm.nih.gov/pmc/articles/PMC3505409/.

“German Footwear Maker to Shift Production to India from China.” Mint, 19 May 2020, www.livemint.com/companies/news/german-footwear-maker-to-shift-production-to-india-from-china-11589882556854.html.

Reynolds, Isabel. “Japan to Fund Firms to Shift Production Out of China.” BloombergQuint, Bloomberg Quint, 10 Apr. 2020, www.bloombergquint.com/global-economics/japan-to-fund-firms-to-shift-production-out-of-china.

Damodaran, Aswath. “Musings on Markets.” August 2020, 1 Jan. 1970, aswathdamodaran.blogspot.com/2020/08/.

Tan, Huileng. “China’s Exports Rose 7.2% on-Year in July Due to Demand for Medical Supplies.” CNBC, CNBC, 7 Aug. 2020, www.cnbc.com/2020/08/07/china-trade-exports-and-imports-in-july.html.

Yao, Kevin. “China Pursues Economic Self-Reliance as External Risks Grow: Advisers.” Reuters, Thomson Reuters, 4 Aug. 2020, www.reuters.com/article/us-china-economy-strategy/china-pursues-economic-self-reliance-as-external-risks-grow-advisers-idUSKCN25031K.

Hofstetter, Sarah. “How Brands Can Address The Hyperdrive Impact Of COVID-19 On E-Commerce.” Forbes, Forbes Magazine, 6 Apr. 2020, www.forbes.com/sites/sarahhofstetter/2020/04/06/hyperdrive-impact-of-covid-19-on-e-commerce/.

Dollar, David, and Anna Newby. “How Is COVID-19 Affecting US Trade?” Brookings, Brookings, 10 Aug. 2020, www.brookings.edu/podcast-episode/how-is-covid-19-affecting-us-trade/.

Dalio, Ray. “Big Debt Crises.” Order Ray Dalio’s Principles Today, www.principles.com/big-debt-crises/.

Written by Stefan Hall, Project Lead. “COVID-19 Is Taking Gaming and Esports to the next Level.” World Economic Forum, www.weforum.org/agenda/2020/05/covid-19-taking-gaming-and-esports-next-level/.